Tax Brackets 2019 California Single . This means that these brackets applied to all. Calculate your tax using our calculator or look it up in a. What is the single income tax filing type? the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. find prior year tax rate schedules using the forms and publications search. california — single tax brackets. Read down the column labeled “if your taxable income is.” to find the range that includes your taxable. Single is the filing type used by all. 1004 rows to find your tax:

from pdfprof.com

1004 rows to find your tax: Single is the filing type used by all. Read down the column labeled “if your taxable income is.” to find the range that includes your taxable. find prior year tax rate schedules using the forms and publications search. What is the single income tax filing type? This means that these brackets applied to all. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. Calculate your tax using our calculator or look it up in a. california — single tax brackets.

2019 tax brackets married filing single

Tax Brackets 2019 California Single Single is the filing type used by all. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. find prior year tax rate schedules using the forms and publications search. Calculate your tax using our calculator or look it up in a. What is the single income tax filing type? 1004 rows to find your tax: This means that these brackets applied to all. Single is the filing type used by all. Read down the column labeled “if your taxable income is.” to find the range that includes your taxable. california — single tax brackets.

From taxfoundation.org

2017 Tax Brackets Tax Foundation Tax Foundation Tax Brackets 2019 California Single Calculate your tax using our calculator or look it up in a. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. california — single tax brackets. Single is the filing type used by all. Read down the column labeled “if your taxable income is.” to find the range that includes your taxable.. Tax Brackets 2019 California Single.

From www.ntu.org

Tax Brackets for 2021 and 2022 Publications National Taxpayers Union Tax Brackets 2019 California Single Read down the column labeled “if your taxable income is.” to find the range that includes your taxable. What is the single income tax filing type? 1004 rows to find your tax: the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. Single is the filing type used by all. find prior. Tax Brackets 2019 California Single.

From www.portebrown.com

Low Tax Rates Provide Opportunity to "Cash Out" with Dividends Tax Brackets 2019 California Single california — single tax brackets. What is the single income tax filing type? 1004 rows to find your tax: Single is the filing type used by all. This means that these brackets applied to all. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. Read down the column labeled “if your. Tax Brackets 2019 California Single.

From www.westernstatesfinancial.com

2020 State of CA Tax Brackets Western States Financial & Western States Investments Corona Tax Brackets 2019 California Single 1004 rows to find your tax: california — single tax brackets. This means that these brackets applied to all. Read down the column labeled “if your taxable income is.” to find the range that includes your taxable. Single is the filing type used by all. the standard deduction in california is $5,202 for single filers and $10,404. Tax Brackets 2019 California Single.

From www.purposefulfinance.org

IRS 2019 Tax Tables, Deductions, & Exemptions — purposeful.finance Tax Brackets 2019 California Single Read down the column labeled “if your taxable income is.” to find the range that includes your taxable. This means that these brackets applied to all. Calculate your tax using our calculator or look it up in a. What is the single income tax filing type? find prior year tax rate schedules using the forms and publications search. . Tax Brackets 2019 California Single.

From www.pdfprof.com

2019 tax brackets california and federal Tax Brackets 2019 California Single 1004 rows to find your tax: What is the single income tax filing type? Read down the column labeled “if your taxable income is.” to find the range that includes your taxable. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. Calculate your tax using our calculator or look it up in. Tax Brackets 2019 California Single.

From maxiqmonica.pages.dev

Tax Brackets 2024 Single Tabby Faustine Tax Brackets 2019 California Single What is the single income tax filing type? the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. Single is the filing type used by all. This means that these brackets applied to all. find prior year tax rate schedules using the forms and publications search. california — single tax brackets. . Tax Brackets 2019 California Single.

From www.businessinsider.com

How 2018 tax brackets could change under Trump tax plan, in 2 charts Business Insider Tax Brackets 2019 California Single find prior year tax rate schedules using the forms and publications search. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. california — single tax brackets. Single is the filing type used by all. Read down the column labeled “if your taxable income is.” to find the range that includes your. Tax Brackets 2019 California Single.

From verieewlola.pages.dev

Federal Tax Brackets 2024 Single Mela Stormi Tax Brackets 2019 California Single Read down the column labeled “if your taxable income is.” to find the range that includes your taxable. california — single tax brackets. What is the single income tax filing type? Single is the filing type used by all. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. 1004 rows to. Tax Brackets 2019 California Single.

From singletrackaccounting.com

5 Tax Saving Strategies for Small Businesses Singletrack Accounting Tax Brackets 2019 California Single find prior year tax rate schedules using the forms and publications search. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. california — single tax brackets. Read down the column labeled “if your taxable income is.” to find the range that includes your taxable. 1004 rows to find your tax:. Tax Brackets 2019 California Single.

From brokeasshome.com

2017 Federal Tax Tables Tax Brackets 2019 California Single This means that these brackets applied to all. Single is the filing type used by all. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. Calculate your tax using our calculator or look it up in a. Read down the column labeled “if your taxable income is.” to find the range that includes. Tax Brackets 2019 California Single.

From swirled.com

2019 Tax Guide What You Need To Know This Year Tax Brackets 2019 California Single Single is the filing type used by all. Calculate your tax using our calculator or look it up in a. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. This means that these brackets applied to all. 1004 rows to find your tax: find prior year tax rate schedules using the. Tax Brackets 2019 California Single.

From andmoretros.weebly.com

2020 california tax brackets andmoreTros Tax Brackets 2019 California Single Single is the filing type used by all. Calculate your tax using our calculator or look it up in a. 1004 rows to find your tax: california — single tax brackets. Read down the column labeled “if your taxable income is.” to find the range that includes your taxable. This means that these brackets applied to all. What. Tax Brackets 2019 California Single.

From www.aarp.org

IRS Sets 2024 Tax Brackets with Inflation Adjustments Tax Brackets 2019 California Single find prior year tax rate schedules using the forms and publications search. Calculate your tax using our calculator or look it up in a. 1004 rows to find your tax: california — single tax brackets. This means that these brackets applied to all. the standard deduction in california is $5,202 for single filers and $10,404 for. Tax Brackets 2019 California Single.

From pdfprof.com

2019 tax brackets california single Tax Brackets 2019 California Single This means that these brackets applied to all. 1004 rows to find your tax: Read down the column labeled “if your taxable income is.” to find the range that includes your taxable. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. find prior year tax rate schedules using the forms and. Tax Brackets 2019 California Single.

From www.businessinsider.com

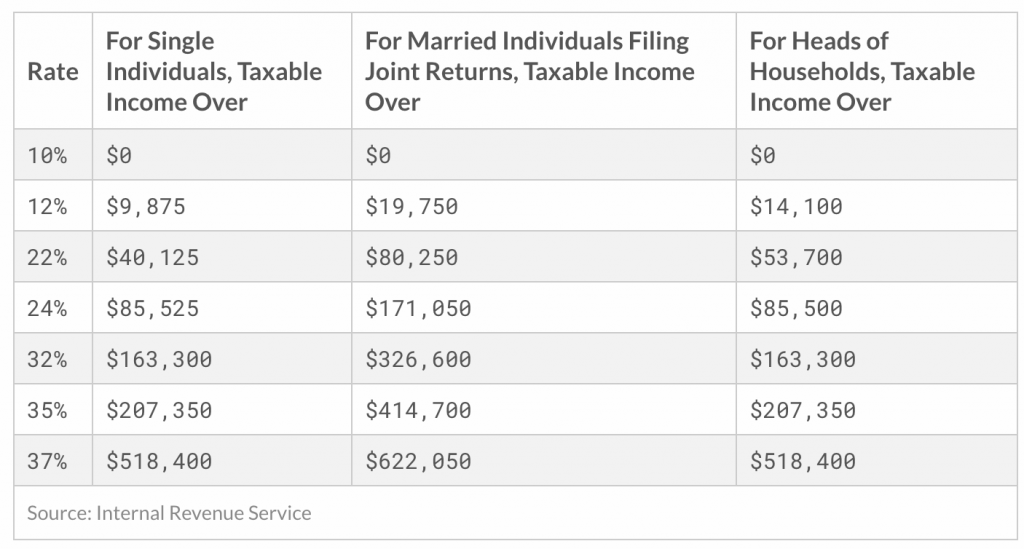

Tax Day 2019 New tax brackets for single, married, head of household Business Insider Tax Brackets 2019 California Single find prior year tax rate schedules using the forms and publications search. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. What is the single income tax filing type? Read down the column labeled “if your taxable income is.” to find the range that includes your taxable. This means that these brackets. Tax Brackets 2019 California Single.

From www.aol.com

Here's how the new US tax brackets for 2019 affect every American taxpayer AOL Finance Tax Brackets 2019 California Single Calculate your tax using our calculator or look it up in a. Single is the filing type used by all. california — single tax brackets. find prior year tax rate schedules using the forms and publications search. This means that these brackets applied to all. 1004 rows to find your tax: the standard deduction in california. Tax Brackets 2019 California Single.

From cabinet.matttroy.net

California Tax Tables 2017 Matttroy Tax Brackets 2019 California Single 1004 rows to find your tax: Calculate your tax using our calculator or look it up in a. What is the single income tax filing type? california — single tax brackets. This means that these brackets applied to all. the standard deduction in california is $5,202 for single filers and $10,404 for joint filers. find prior. Tax Brackets 2019 California Single.